Category: Tax Insights

-

Photo: Kelly Sikkema – Unsplash

Photo: Kelly Sikkema – UnsplashJuly Insights

Hobby IncomeIf you have income from sources other than your main job, how do you know whether it’s income from a business or hobby? The distinction between the two makes a big difference in your taxes. Look at the following nine factors when making the determination. Do you: 1. Operate in a businesslike manner? Do…

-

Photo: TRUiC – Google

Photo: TRUiC – GoogleJune Insights

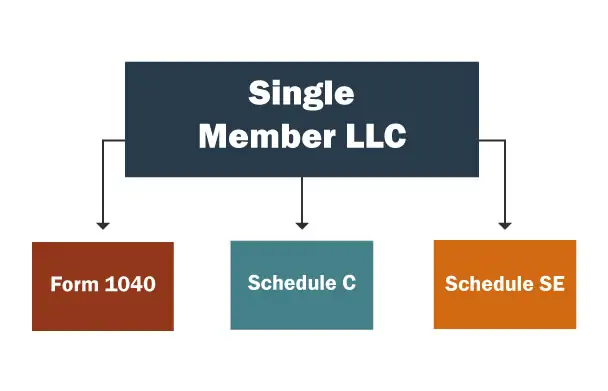

Single-member LLCs Editor: Shaun M. Hunley, J.D., LL.M. June 1, 2023 All states permit single-member (one-owner) limited liability companies (SMLLCs). A domestic SMLLC, by default, is a disregarded entity for federal income tax purposes. In that case, an SMLLC owned by an individual is treated as a sole proprietorship (or owner of rental property), while…

-

Photo: Shubham Dhage – Unsplash

Photo: Shubham Dhage – UnsplashMay Insights

Digital Assets vs Cryptocurrency Cryptocurrency and digital assets are often used interchangeably, but they can refer to slightly different things. Cryptocurrency is a type of digital asset that uses cryptography for secure financial transactions. Cryptocurrencies are decentralized and operate on a distributed ledger technology called a blockchain. Bitcoin and Ethereum are examples of well-known cryptocurrencies.…

-

Photo: Jhon Jim-Unslpash

Photo: Jhon Jim-Unslpash -

Photo: CHUTTERSNAP – Unsplash

Photo: CHUTTERSNAP – UnsplashMarch Insights 2023

EV Tax Credits in 2023 or After Credits for new clean vehicles purchased in 2023 or after If you place in service a new plug-in electric vehicle (EV) or fuel cell vehicle (FCV) in 2023 or after, you may qualify for a clean vehicle tax credit. At the time of sale, a seller must give you…

-

Photo: James Hose Jr. – Unsplash

Photo: James Hose Jr. – UnsplashIRS clarifies required minimum distribution reporting

By Martha Waggoner March 8, 2023 The IRS provided guidance to financial institutions regarding reporting for required minimum distributions (RMDs), the rules for which were changed by the SECURE 2.0 Act. The SECURE 2.0 Act, which was enacted as Division T of the Consolidated Appropriations Act, 2023, P.L. 117-328, delayed the required beginning date for…

-

Photo: Nick Fewings – Unsplash

Photo: Nick Fewings – UnsplashBusiness standard mileage rate increases for 2023

By Martha Waggoner January 3, 2023 The IRS increased the optional standard mileage rate used to calculate the deductible costs of operating a vehicle for business to 65.5 cents per mile driven, up 3 cents from a rare midyear increase in 2022. The increased rate was effective as of Jan. 1, 2023 (Notice 2023-03). The…

-

Photo: Olga DeLawrence – Unsplash

Photo: Olga DeLawrence – UnsplashSECURE Act 2.0

President Biden closed out 2022 by signing a legislative package into law that included the Securing a Strong Retirement Act of 2022—or as it is more commonly known: SECURE 2.0. Supporters of the bipartisan legislation say it will increase access to 401(k) and individual retirement plans, especially among low- to middle-income workers. It is also…