Category: Tax Insights

-

Photo: Island Organizers

Photo: Island OrganizersMay Insights

Issue Number: IRS Tax Tip 2024-44 Emergency preparedness plans for businesses should include financial records When business owners put together an emergency preparedness plan, it should include copies of vital records and financial information. Here are some things everyone can do to help protect their financial records. Update emergency preparedness plan annuallyPersonal and business situations…

-

Photo: Liberty Tax Service

Photo: Liberty Tax ServiceApril Insights

Issue Number: IRS Tax Tip 2024-35 Debunking common myths about federal tax refunds Once people complete and file their tax return, many of them eagerly await any refund they may be owed. Knowing fact from fiction can help manage expectations as they wait for their money. Myth: Calling the IRS, a tax software provider or a…

-

Photo: Pavese Law Firm

Photo: Pavese Law FirmMarch Insights

Independent Contractor vs Employee Which are you?For federal tax purposes, this is an important distinction. Worker classification affects how you pay your federal income tax, social security and Medicare taxes, and how you file your tax return. Classification affects your eligibility for social security and Medicare benefits, employer provided benefits and your tax responsibilities. If…

-

Photo: ID.me

Photo: ID.meFebruary Insights

Navigating the Digital Tax Landscape: Power of Attorney and ID.me Integration In our tech-driven era, the intersection of legal frameworks and digital platforms is transforming the way we manage financial and tax affairs. For individuals requiring assistance in tax matters, the combination of a Power of Attorney (POA) and registering with platforms like ID.me is…

-

Photo: Julius Yls

Photo: Julius YlsJanuary Insights 2024

Maximizing contributions to your retirement accounts. Here are a few key points to consider: If you’re interested in exploring this further or have any questions about how contributing to retirement accounts can benefit you, please don’t hesitate to reach out. We can discuss your unique situation and tailor a plan that aligns with your financial…

-

Photo: Kiplinger

Photo: KiplingerDecember Insights

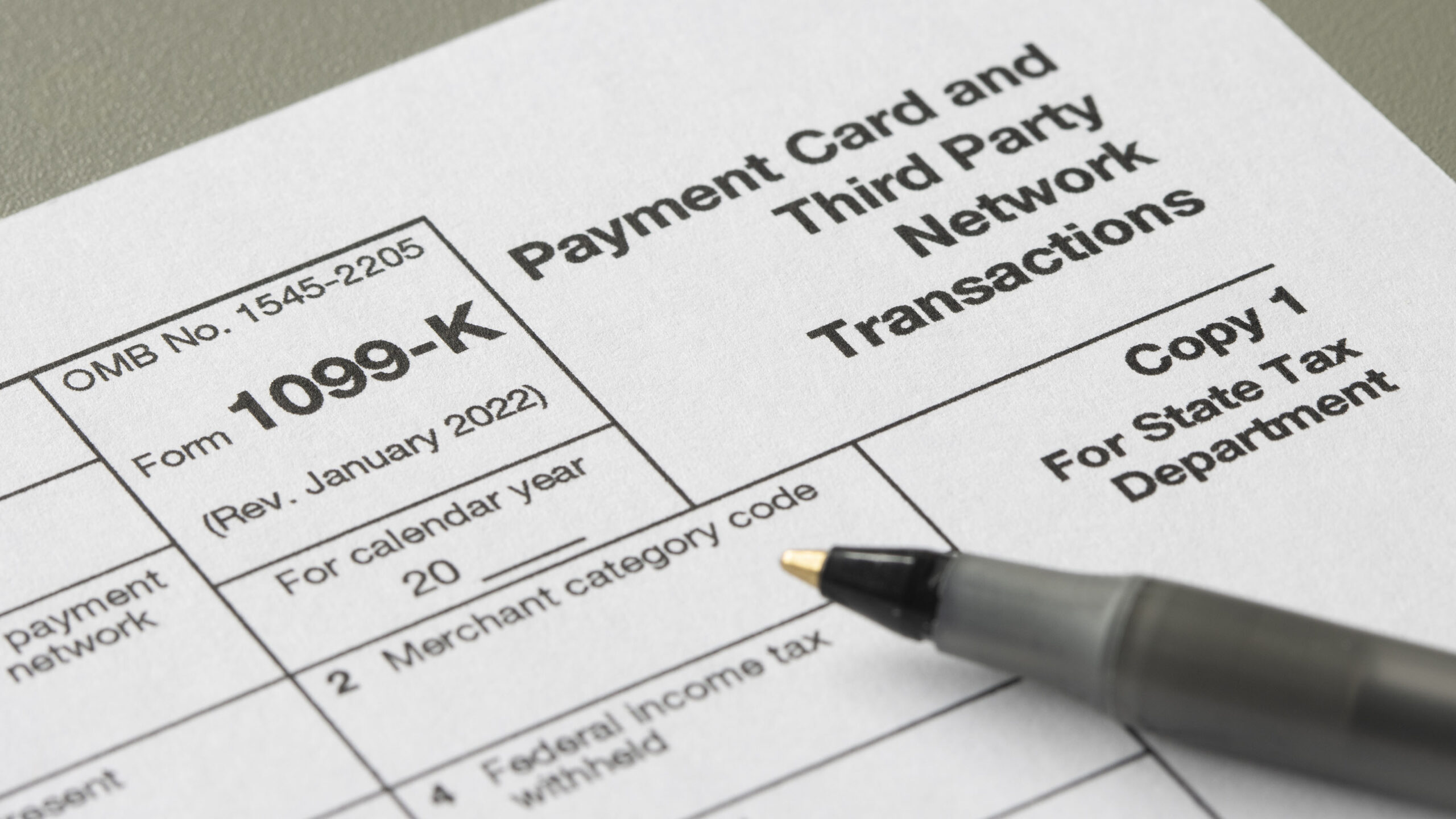

IRS delays 1099-K rules for ticket sales, announces new $5,000 threshold for 2024 Susan Tompor Detroit Free Press The IRS delivered on Tuesday an unexpected, but welcomed, early Christmas gift to gig workers, Taylor Swift ticket sellers and more. The IRS surprised many tax professionals and others when it said it would delay new requirements…

-

Photo: Investopedia

Photo: InvestopediaNovember Insights

Tax Credit Opportunities 2023 As we approach the 2023 tax year, I wanted to bring your attention to some key tax credits that may be applicable to your situation. Understanding and leveraging these credits can significantly impact your tax liability. Here are a few noteworthy tax credits for consideration: Remember, tax laws are subject to…

-

Photo: Investopedia

Photo: InvestopediaOctober Insights

What Is a W-4 Form? How to Fill Out an Employee’s Withholding Certificate in 2024 How to fill out a 2024 W-4 form Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and state and local authorities (if applicable) on behalf of employees. How you fill out a…

-

Photo: Steve Johnson – Unsplash

Photo: Steve Johnson – UnsplashSeptember Insights

How Is AI used in business AI is a game-changer for businesses, offering a range of applications to enhance efficiency, decision-making, and customer experiences. Here are some ways AI is commonly used in business: These applications highlight the versatility and impact of AI across various business functions. As technology advances, businesses continue to explore new…

-

Photo: Starline – Freepik

Photo: Starline – FreepikAugust Insights

2023 Dirty Dozen List from IRS The Internal Revenue Service wrapped up the annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season. Many of these schemes peak during filing season as people prepare their…