Author: Admin

-

Photo: ID.me

Photo: ID.meFebruary Insights

Navigating the Digital Tax Landscape: Power of Attorney and ID.me Integration In our tech-driven era, the intersection of legal frameworks and digital platforms is transforming the way we manage financial and tax affairs. For individuals requiring assistance in tax matters, the combination of a Power of Attorney (POA) and registering with platforms like ID.me is…

-

Photo: SC&H Group

Photo: SC&H GroupBeneficial Ownership Information

Starting January 1, 2024, a significant number of businesses will be required to comply with the Corporate Transparency Act (“CTA). The CTA was enacted into law as part of the National Defense Act for Fiscal Year 2021. The CTA requires the disclosure of the beneficial ownership information (otherwise known as “BOI”) of certain entities from…

-

Photo: Julius Yls

Photo: Julius YlsJanuary Insights 2024

Maximizing contributions to your retirement accounts. Here are a few key points to consider: If you’re interested in exploring this further or have any questions about how contributing to retirement accounts can benefit you, please don’t hesitate to reach out. We can discuss your unique situation and tailor a plan that aligns with your financial…

-

Photo: Kiplinger

Photo: KiplingerDecember Insights

IRS delays 1099-K rules for ticket sales, announces new $5,000 threshold for 2024 Susan Tompor Detroit Free Press The IRS delivered on Tuesday an unexpected, but welcomed, early Christmas gift to gig workers, Taylor Swift ticket sellers and more. The IRS surprised many tax professionals and others when it said it would delay new requirements…

-

Photo: Investopedia

Photo: InvestopediaNovember Insights

Tax Credit Opportunities 2023 As we approach the 2023 tax year, I wanted to bring your attention to some key tax credits that may be applicable to your situation. Understanding and leveraging these credits can significantly impact your tax liability. Here are a few noteworthy tax credits for consideration: Remember, tax laws are subject to…

-

Photo: Investopedia

Photo: InvestopediaOctober Insights

What Is a W-4 Form? How to Fill Out an Employee’s Withholding Certificate in 2024 How to fill out a 2024 W-4 form Employers use the W-4 to calculate certain payroll taxes and remit the taxes to the IRS and state and local authorities (if applicable) on behalf of employees. How you fill out a…

-

Photo: Steve Johnson – Unsplash

Photo: Steve Johnson – UnsplashSeptember Insights

How Is AI used in business AI is a game-changer for businesses, offering a range of applications to enhance efficiency, decision-making, and customer experiences. Here are some ways AI is commonly used in business: These applications highlight the versatility and impact of AI across various business functions. As technology advances, businesses continue to explore new…

-

Photo: Starline – Freepik

Photo: Starline – FreepikAugust Insights

2023 Dirty Dozen List from IRS The Internal Revenue Service wrapped up the annual Dirty Dozen list of tax scams for 2023 with a reminder for taxpayers, businesses and tax professionals to watch out for these schemes throughout the year, not just during tax season. Many of these schemes peak during filing season as people prepare their…

-

Photo: Kelly Sikkema – Unsplash

Photo: Kelly Sikkema – UnsplashJuly Insights

Hobby IncomeIf you have income from sources other than your main job, how do you know whether it’s income from a business or hobby? The distinction between the two makes a big difference in your taxes. Look at the following nine factors when making the determination. Do you: 1. Operate in a businesslike manner? Do…

-

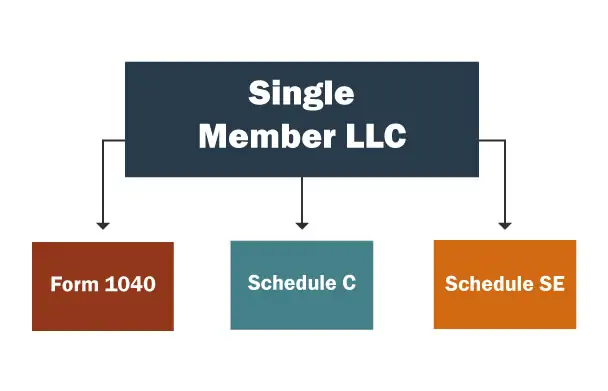

Photo: TRUiC – Google

Photo: TRUiC – GoogleJune Insights

Single-member LLCs Editor: Shaun M. Hunley, J.D., LL.M. June 1, 2023 All states permit single-member (one-owner) limited liability companies (SMLLCs). A domestic SMLLC, by default, is a disregarded entity for federal income tax purposes. In that case, an SMLLC owned by an individual is treated as a sole proprietorship (or owner of rental property), while…