Single-member LLCs

Editor: Shaun M. Hunley, J.D., LL.M.

June 1, 2023

All states permit single-member (one-owner) limited liability companies (SMLLCs). A domestic SMLLC, by default, is a disregarded entity for federal income tax purposes. In that case, an SMLLC owned by an individual is treated as a sole proprietorship (or owner of rental property), while an SMLLC owned by a corporation is treated as a branch or division. But an SMLLC can elect corporate classification (Regs. Sec. 301.7701-2(a)). An SMLLC that elects to be classified as a corporation can also make an S election if all the qualifications for S status are met (IRS Letter Ruling 9636007). In fact, under Regs. Sec. 301.7701-3(c) (1)(v)(C), an eligible entity that timely elects to be an S corporation is treated as having made an election to be classified as a corporation, provided that as of the effective date of the S election, the entity meets all other requirements to qualify as an S corporation.

Using disregarded SMLLCs

Individuals can form disregarded SMLLCs to obtain limited liability protection under applicable state law without altering the way they report business or rental income and expenses on their individual federal income tax returns. Individuals can also form disregarded SMLLCs to hold nonbusiness assets (such as investments). The income and expenses related to those assets are reported by the owner as if the SMLLC did not exist. A disregarded SMLLC may also be useful to a corporation that wishes to engage in a new line of business without forming a subsidiary. The LLC, unlike a corporate subsidiary, is taxed as an unincorporated branch or division of its corporate owner, thus avoiding the consolidated-return rules. Practitioners should be careful when structuring transactions using disregarded SMLLCs — for example, individuals cannot form a partnership with their wholly owned disregarded SMLLCs because the individual and the SMLLC are treated as a single person, and a partnership needs more than one partner.

Caution: An IRS Office of Chief Counsel legal advice memorandum (AM 2012-001) clarifies that state laws allowing different classes of interests in disregarded entities are irrelevant for federal tax purposes. Regardless of state law, the owner of a disregarded SMLLC may not split its interest into separate classes of interests and may not separately allocate items of income, deductions, losses, credits, and basis among those classes.

Liability for federal taxes: Practitioners should be aware that the IRS may have notification alternatives in cases involving the federal tax liability of a disregarded entity. For example, Field Service Advice memo 200114006 determined that tax assessments made in the name and employer identification number (EIN) of an SMLLC but mailed to the owner of the entity were valid. Because of his close relationship to the LLC, the sole member could not assert lack of knowledge of the assessment as a defense.

Liability for transfer taxes: In many states, the sale or transfer of real estate between entities and individuals is subject to a transfer tax based on the property’s fair market value or selling price. In general, exemptions exist for transfers between related parties in the form of a capital contribution or a taxfree reorganization. In most cases, states provide a similar exemption for LLCs and their members.

Federal tax liens: In Berkshire Bank v. Town of Ludlow, 708 F.3d 249 (1st Cir. 2013), the First Circuit agreed with a Massachusetts district court that an SMLLC was a nominee for its individual member for purposes of attaching a federal tax lien. Some of the facts considered in the case were that (1) the member transferred property to the LLC for no consideration; (2) no one else had any interest in the LLC, made decisions for the company, or benefited from its income; (3) the member exercised total control over the LLC and had complete use and enjoyment of the property owned by the LLC; and (4) the member used 10% to 15% of the LLC’s revenue to pay his personal expenses.

Adding members to an SMLLC

The business activities of an SMLLC could grow to the point that additional members need to be admitted. Unless it elects corporate status, a domestic disregarded SMLLC is classified as a partnership on the date it has more than one member. In Rev. Rul. 2004-77, however, the IRS ruled that if an eligible entity has two members under local law but one of the members is a disregarded entity owned by the other member, the eligible entity cannot be classified as a partnership and is either taxed as a disregarded entity or can elect to be taxed as a corporation.

Filing issues for disregarded SMLLCs

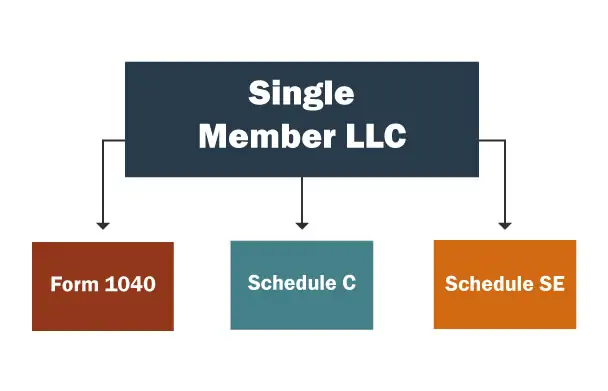

The owner of a disregarded SMLLC reports the income and expenses of the LLC on its federal income tax return. A disregarded SMLLC is not required to file an income tax return and generally is not required to have its own EIN. However, according to the instructions to Form SS-4, Application for Employer Identification Number, any entity must have an EIN if it has a pension plan. Also, an SMLLC that is liable for payroll taxes and certain excise taxes must have its own EIN.

Payroll taxes: Disregarded entity status does not apply for the reporting, collection, and payment of federal employment taxes (including federal income tax withholding, Federal Insurance Contributions Act (FICA), and Federal Unemployment Tax Act (FUTA) taxes). For these purposes, the disregarded entity must have a separate EIN from its owner; file all quarterly or annual employment tax returns, annual unemployment tax returns, and Forms W-2, Wage and Tax Statement; and fulfill any other reporting or withholding requirements under the employment tax rules. The disregarded entity is treated as a corporation for employment tax purposes with respect to any employees other than the owner. An individual owner of a disregarded entity is treated as a sole proprietor subject to self-employment tax (i.e., is not an employee of the LLC for employment tax purposes) (Regs. Sec. 301.7701-2(c)(2)(iv)).

Caution: A disregarded SMLLC owned by a partnership (including an LLC classified as a partnership) is not treated as a corporation for employing any partners of the partnership. Instead, the SMLLC is disregarded for this purpose and is not the employer of any partner of the partnership that owns the SMLLC. A partner in a partnership that owns a disregarded SMLLC is treated as self-employed, in the same manner that a partner in a partnership that does not own an interest in an SMLLC is treated as self-employed (Regs. Sec. 301.7701-2(c)(2)(iv)(C)(2)). This rule is intended to stop partnerships from forming an SMLLC to “employ” their partners and then treat those individuals as employees for furnishing tax-favored employee benefits (i.e., tax-free employee benefits that would have been taxable had they been furnished to a partner).

Excise taxes: A disregarded SMLLC is treated as a corporation (i.e., a separate taxable entity) for certain federal excise tax purposes (Regs. Sec. 301.7701-2(c)(2)(iii)). An example in the regulations provides that where a domestic corporation is merged into an SMLLC, the SMLLC is the successor to the corporation and is responsible for all its debts. If the IRS later discovered a corporate excise tax deficiency, the SMLLC would be liable for the deficiency (and a failure to pay the assessed amount would result in a tax lien against all of the SMLLC’s rights to property).

Gift taxes: In Pierre, 133 T.C. 24 (2009), the IRS attempted to disregard an SMLLC for gift tax purposes because it was a disregarded entity for income tax purposes. While agreeing that the SMLLC was a valid entity under New York law, the IRS contended that the owner did not elect to treat it as a separate entity for income tax purposes, so the SMLLC should be disregarded for gift tax purposes. Therefore, the owner transferred a proportionate share of the SMLLC’s underlying assets, not interests in the SMLLC. A majority of the Tax Court disagreed with the IRS, reasoning that the income tax rules should not result in ignoring a validly formed entity for federal gift tax purposes.

Using disregarded SMLLCs in like-kind exchanges

In IRS Letter Rulings 9807013 and 200807005, a limited partnership involved in a like-kind exchange organized disregarded SMLLCs to take title to replacement property. The IRS concluded that since an SMLLC took title to qualified replacement property and it was disregarded for federal taxes, the limited partnership would be treated as if it had acquired the replacement property directly. A similar conclusion was reached when the like-kind exchange involved a corporation and its wholly owned LLC (IRS Letter Ruling 9850001).

Example: RW Inc. is a real estate investment S corporation owned by A. The corporation wishes to dispose of a rental real property in a like-kind exchange. A would like to segregate the liability associated with each rental real property acquired in the exchange, and his banker would prefer to provide financing to a single asset entity to improve the bank’s position in the event of a default. To accomplish both objectives, RW transfers real estate to a qualified intermediary to be sold. The intermediary sells the property and uses those funds, along with additional bank financing, to acquire qualified replacement properties. The intermediary transfers each replacement property to an SMLLC owned by RW Inc. Since the SMLLCs are disregarded, RW is deemed to have acquired the replacement property and consummated the like-kind exchange, assuming all the other requirements of Sec. 1031 are met.

In a slightly different situation, IRS Letter Ruling 200118023 concluded that an SMLLC is disregarded in the like-kind exchange transaction, so that a taxpayer who received an ownership interest in an SMLLC that held replacement property successfully completed a like-kind exchange.

Corporate acquisitions or reorganizations involving disregarded SMLLCs

Regs. Sec. 1.368-2 allows certain transactions involving disregarded entities that have a single corporate owner to qualify as statutory mergers under Sec. 368(a)(1)(A) (Type A mergers). For a merger to qualify under the rules, all of the assets and liabilities of each member of one or more combining units (other than those transferred or discharged in the transaction) must become the assets and liabilities of one or more members of one other combining unit. For this purpose, a combining unit generally is a corporation and one or more disregarded entities owned by the corporation. An additional requirement is that each transferor corporation involved in the transfer must cease its separate legal existence.

The regulation clarifies that (1) a combining entity is a corporation that is not a disregarded entity, and (2) a transferor unit of a combining entity may continue to exist for certain limited legal purposes, such as to finalize any outstanding lawsuits. It also liberalizes the “substantially all” asset test that normally applies to tax-free reorganizations. Transactions that do not qualify as Type A mergers may qualify as tax-free reorganizations under Sec. 368(a)(1)(C) (assets for voting stock); Sec. 368(a)(1) (D) (assets transferred to a controlled corporation or its stockholders); or Sec. 368(a)(1)(F) (change of identity, etc.), provided all statutory requirements are met. An asset transfer in exchange for stock may also be tax-free under the rules of Sec. 351.

Disregarded SMLLC as an S corporation shareholder or subsidiary

A disregarded SMLLC can be an S corporation shareholder, provided the SMLLC’s sole member is an eligible shareholder under Sec. 1361 (IRS Letter Ruling 9745017). A similar result was reached when an eligible trust formed an SMLLC to hold stock in an S corporation. Similarly, if a disregarded SMLLC is owned by an S corporation and the SMLLC owns a corporation that would otherwise qualify as a qualified Subchapter S subsidiary (QSub), the existence of the LLC is disregarded, and the corporation owned by the LLC is treated as a QSub (Regs. Sec. 1.1361-2(d), Example 2).

Accounting methods

Usually, a disregarded SMLLC uses the same accounting methods as its owner. However, a disregarded SMLLC may have a trade or business separate from that of its owner, in which case the trade or business conducted by the SMLLC can use a different accounting method than that of other activities conducted by its owner (Regs. Sec. 1.446-1(d)).